The smart Trick of Medicare Graham That Nobody is Talking About

The smart Trick of Medicare Graham That Nobody is Talking About

Blog Article

The Ultimate Guide To Medicare Graham

Table of ContentsFacts About Medicare Graham RevealedMedicare Graham Things To Know Before You Get ThisThings about Medicare GrahamGetting My Medicare Graham To WorkFascination About Medicare Graham

Prior to we talk regarding what to ask, let's talk about that to ask. For several, their Medicare trip begins directly with , the official internet site run by The Centers for Medicare and Medicaid Services.

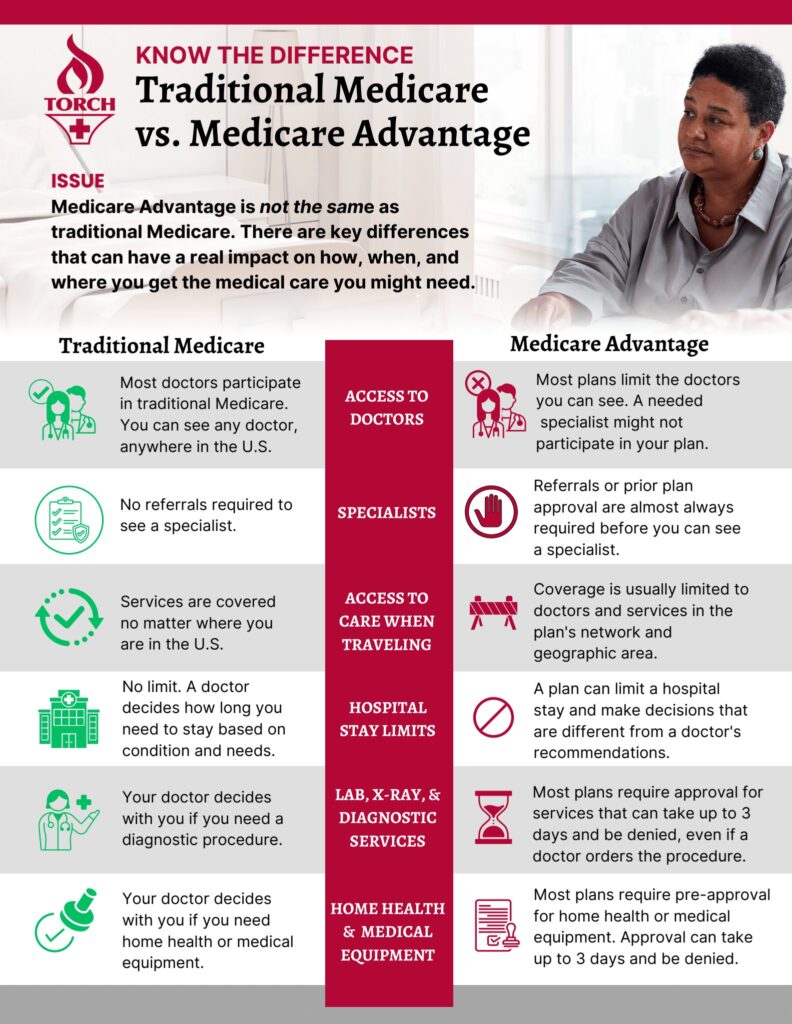

It covers Component A (health center insurance coverage) and Part B (medical insurance). This includes things that are considered clinically essential, such as healthcare facility remains, routine medical professional check outs, outpatient services and more. is Medicare insurance coverage that can be bought directly from an exclusive healthcare firm. These strategies function as an alternative to Initial Medicare while providing even more benefits - Medicare South Florida.

Medicare Component D intends assistance cover the expense of the prescription drugs you take at home, like your everyday medications. You can enroll in a different Component D plan to add medicine coverage to Original Medicare, a Medicare Price plan or a couple of various other kinds of plans. For numerous, this is usually the initial concern considered when looking for a Medicare plan.

The Buzz on Medicare Graham

To get one of the most economical healthcare, you'll want all the services you use to be covered by your Medicare strategy. Some covered services are entirely complimentary to you, like going to the medical professional for preventative care screenings and tests. Your strategy pays everything. For others like seeing the medical professional for a sticking around sinus infection or filling up a prescription for covered antibiotics you'll pay a fee.

and seeing a service provider who approves Medicare. What about traveling abroad? Many Medicare Advantage plans provide worldwide protection, in addition to insurance coverage while you're taking a trip locally. If you intend on taking a trip, make certain to ask your Medicare consultant regarding what is and isn't covered. Maybe you've been with your current physician for a while, and you want to keep seeing them.

Medicare Graham Things To Know Before You Get This

Many individuals who make the switch to Medicare proceed seeing their normal doctor, however, for some, it's not that straightforward. If you're collaborating with a Medicare expert, you can inquire if your physician will remain in network with your new plan. If you're looking at strategies separately, you might have to click some web links and make some telephone calls.

For Medicare Benefit strategies and Cost plans, you can call the insurance provider to see to it the doctors you desire to see are covered by the plan you want. You can additionally examine the strategy's internet site to see if they have an online search tool to locate a protected medical professional or center.

Which Medicare plan should you go with? That's the finest component you have alternatives. And eventually, the option depends on you. Bear in mind, when starting, it is very important to make certain you're as notified as feasible. Begin with a checklist of considerations, ensure you're asking the ideal questions and start concentrating on what sort of plan will best offer you and your needs.

Some Ideas on Medicare Graham You Should Know

Are you ready to turn 65 and become freshly eligible for Medicare? Choosing a strategy is a large decisionand it's not constantly an easy one. There are essential things you must know up front. For instance, the least expensive plan is not necessarily the best option, and neither is one of the most expensive plan.

Also if you are 65 and still working, it's a great concept to assess your alternatives. People getting Social Protection benefits when transforming 65 will be instantly signed up in Medicare Parts A and B. Based upon your employment circumstance and healthcare alternatives, you may need to consider signing up in Medicare.

Then, take into consideration the various types of Medicare plans offered. Initial Medicare has 2 components: Component A covers a hospital stay and Component B covers medical expenditures. Nevertheless, lots of people find that Parts A and B together still leave gaps in what is covered, so they buy a Medicare supplement (or Medigap) strategy.

Some Known Facts About Medicare Graham.

There is commonly a costs for Part C plans on top of the Component B premium, although some Medicare Benefit plans deal zero-premium strategies. Medicare Lake Worth Beach. Testimonial the insurance coverage details, prices, and any type of additional benefits supplied by each plan you're considering. If you enlist in original Medicare (Parts A and B), your premiums and insurance coverage will certainly be the very same as other individuals who have Medicare

(https://www.abnewswire.com/companyname/medicaregraham.com_151494.html#detail-tab)This is a set quantity you may need to pay as your share of the price for care. A copayment is a fixed amount, like $30. This is one of the most a Medicare Benefit member will certainly have to pay out-of-pocket for covered solutions yearly. The amount varies by strategy, once you reach that restriction, you'll pay absolutely nothing for protected Part A and Component B services for the remainder of the year.

Report this page